Inner west homeowners set for financial windfall following reveal of Sydney Metro West stations

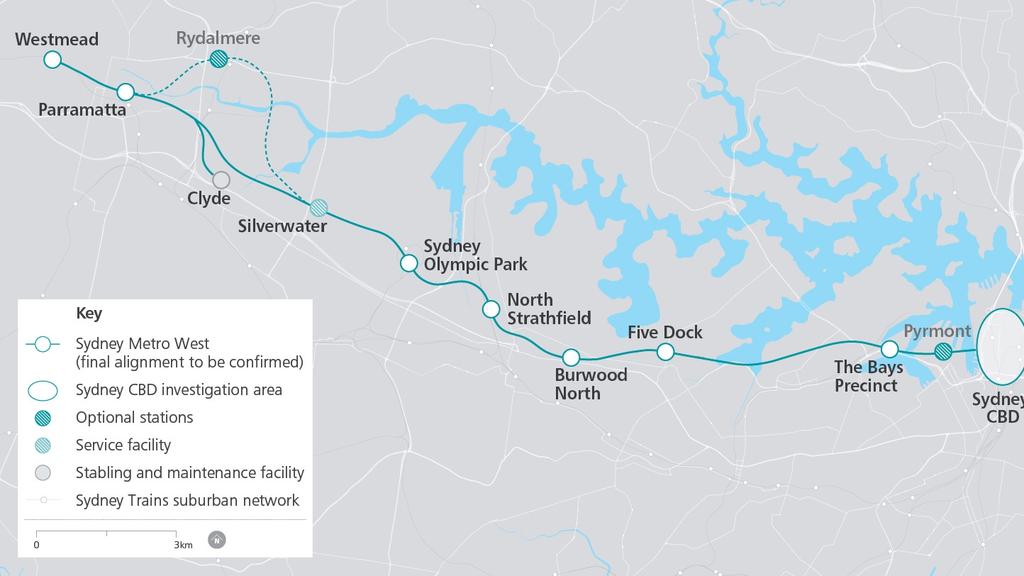

Many homeowners will benefit from the construction of the Sydney Metro West. Picture: AAP Image/Joel Carrett. Property owners will be some of the biggest winners of the NSW Government’s plan to construct the Metro train network from the CBD to the western suburbs. Experts say… Read More »Inner west homeowners set for financial windfall following reveal of Sydney Metro West stations